The Supreme Court on Wednesday refused to immediately clear the way for the Biden administration’s new student loan repayment plan, adding to uncertainty about the future of a program that would affect millions of borrowers.

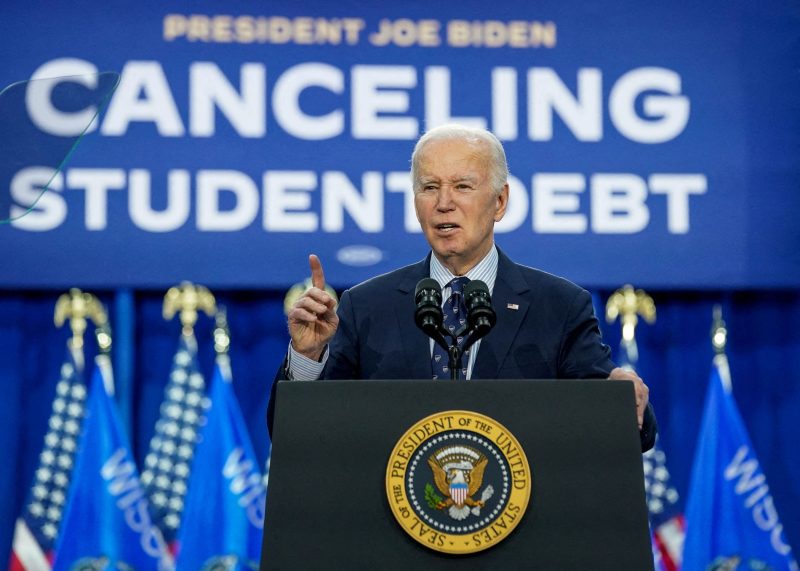

Biden introduced the program, Saving on a Valuable Education, last fall as millions of Americans resumed student loan payments following a hiatus of more than three years because of the pandemic.

The plan, commonly known as SAVE, offered lower monthly payments and a faster path to loan cancellation. It was announced months after the justices divided along ideological lines to invalidate a separate, $400 billion Biden administration program to forgive student loan debt.

More than 8 million people are enrolled in the new program, with debts already cleared for more than 400,000 borrowers.

But ongoing litigation has complicated and essentially stalled the administration’s plans. Republican-led states filed separate lawsuits accusing the president of exceeding his legal authority by creating a program with far-reaching economic impact. The Congressional Budget Office estimates SAVE will cost some $230 billion over the next decade, but the Biden administration says the figure is closer to $156 billion.

The justices were responding Wednesday to separate emergency requests in two cases. With no noted dissents, they left in place a sweeping hold on Biden’s plans issued by the U.S. Court of Appeals for the 8th Circuit while that court weighs the merits of the case. The justices did not include an explanation for their action, but said the court expects the 8th Circuit will “render its decision with appropriate dispatch.”

If the appeals court rules quickly, the case could then be appealed to the Supreme Court this fall, putting the issue of student loan debt back before the justices amid a competitive presidential campaign between Vice President Harris and former president Donald Trump.

In a separate case in June, U.S. District Judge Daniel D. Crabtree of Kansas ruled against the student loan plan and issued an order blocking the government from recalculating and capping monthly payments for borrowers at 5 percent of their discretionary income. But the U.S. Court of Appeals for the 10th Circuit put Crabtree’s order on hold, allowing the Education Department to move forward with cutting monthly bills.

The attorneys general of three states — Alaska, South Carolina and Texas — asked the Supreme Court to reinstate the order while litigation continues and said Biden’s latest plan is essentially defying the high court’s 2023 student loan ruling.

‘This current attempt to unilaterally cancel debt is every bit as unlawful as the first,” the attorneys general told the court in their filing, adding that the Education Department “cannot cancel hundreds of billions of dollars’ worth of student loans without clear authorization from Congress.”

Solicitor General Elizabeth B. Prelogar, defending the program, told the justices that clearing the way for Crabtree’s sweeping order would create “intense confusion” for millions of borrowers if their payments must be recalculated and new bills issued, in addition to upending the work of the department.

In the 8th Circuit case, Prelogar asked the high court to vacate a sweeping injunction against SAVE issued by at the request of seven GOP-led states — Missouri, Arkansas, Florida, Georgia, North Dakota, Ohio and Oklahoma.

The 8th Circuit’s broad order blocks loan forgiveness under all four income-driven repayment plans, not just Save. It is also making it difficult for borrowers to enroll in any of the plans and for loan servicers to process applications.

Missouri Attorney General Andrew Bailey said the Missouri Higher Education Loan Authority, a quasi-state agency that services federal student loans and funds state scholarships, would lose revenue when the loans are canceled. He called the injunction a ‘huge win for every American who still believes in paying their own way.”

Education Secretary Miguel Cardona said in a statement that the 8th Circuit’s ruling would force millions of borrowers to pay hundreds of dollars more each month. The ruling, he said, “rejects a practice of providing loan forgiveness that goes back 30 years.”

Cardona said the department would place all borrowers enrolled in SAVE in an interest-free forbearance while the Biden administration continues to defend the program.

This is a developing story. It will be updated. Justin Jouvenal contributed to this report.